AI Unicorns in China

Did I get enough buzzwords in this article title?

You are probably already familiar with the established AI giants in China - Baidu, Alibaba, Tencent, Huawei, Xiaomi, and iFlyTek. The landscape of AI-tech companies in China (and the rest of the world for that matter) has been expanding in a major way. When you look at the distribution of AI patents held in China, however, only a small percent is owned by the top 10 and 20 patent holders.

We have a diverse field of innovators developing and implementing technologies. It will be interesting to see the companies with the right technologies and business models who succeed in the marketplace.

Artificial intelligence technology is hot these days. Technology has progressed allowing easier access to the processing and power necessary to implement innovative applications and leverage growing datasets. There are many unicorn-esque companies already on the rise in China. From chipsets to robotics to implementation algorithms, investors have been active in providing capital to fuel rapid growth.

Last fall Forbes reported on over a dozen companies receiving active investment and values at over USD $1 Billion. We can take a look at that list and get a sense for how they are protecting their valuable technologies with their IP holdings.

DJI ($15 billion): 3000+ patents

Ubtech Robotics ($5 billion): 155 patents

SenseTime ($4.5 billion): 610 patents

Cambricon ($2.5 billion): 297 patents

Cloudwalk ($2 billion): 43 patents

Megvii Technology ($2 billion): 513 patents

Yitu Technology ($2 billion): 24 patents

Horizon Robotics ($1.5 billion) 55 patents

iCarbonX ($1 billion): 18 patents

Mobvoi ($1 billion): 34 patents

Orbbec ($1 billion): 268 patents

Tongdun ($1 billion): 10 patents

Unisound ($1 billion): 169 patents

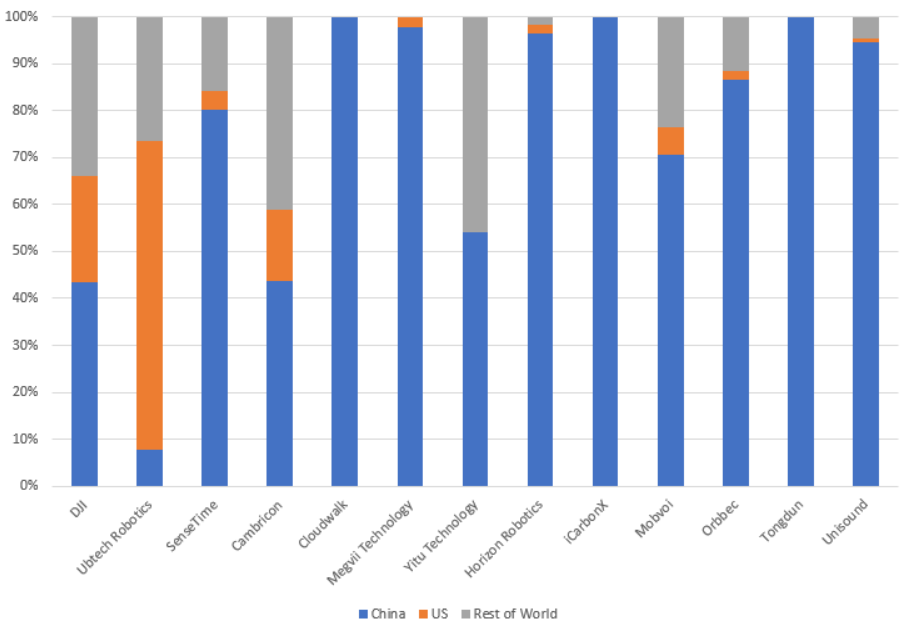

Here is a look at how their IP holdings are distributed across China, the US and the rest of the world

For the most part, the higher valuations correlate to larger patent portfolios. I would not necessarily read any causal relationship from this data. Much can likely be explained by the fact that higher valued companies are doing more R&D and have larger budgets available to file patent applications. The data can be useful to identify outliers and filing strategies that can for business intelligence.

Cloudwalk appears to )be an exception on this list with a smaller (and fully China-centric) portfolio compared to its valuation. This may be explained by their software-focus and strong government ties perhaps reducing the necessity to use patents to deter competitors.

On the other end, Orbbec and Unisound have exceptionally large portfolios compared to their valuation level peers.

The other outlier to note is Ubtech Robotics with a very US-focused patent portfolio. This is a very uncommon approach not just compared to the other companies on this list, but compared to Chinese companies in the AI space in general, where we tend to see a far more domestic-focused IP strategy. IP filing strategy can often times signal the value a company places on a particular market. We can use this data to provide some interesting insights. Ubtech's US focus seems to be reinforced by its partnership with Disney to create character-themed robot products for the consumer market, as well as its early sale of products in Apple Stores.

Check out the Forbes article by Nina Xiang for more information on these companies: China's AI Industry Has Given Birth To 14 Unicorns